Friends of the Forest Preserve District

Be a Friend to Your DuPage Forest Preserves

The Friends of the Forest Preserve District of DuPage County is a 501(c)(3) nonprofit dedicated to providing ways to help care for DuPage forest preserves.

Every year gifts from numerous individuals, companies, and organizations help the Forest Preserve District carry out its mission to maintain nearly 26,000 acres, over 60 forest preserves, 175 miles of trails, 31 lakes, and seven education centers.

We are grateful you’re reflecting on the forest preserves and your experiences by connecting a gift to a preserve, project, or program that’s had an effect on you.

Choose What Your Donation Supports

Greatest Needs in Forest Preserves

Your gift will support habitat restoration, wildlife preservation, and environmental sustainability.

DuPage Wildlife Conservation Center Master Plan

Your gift will advance wildlife rehabilitation, purchase equipment, and enhance education.

Adopt a Blanding's Turtle

Your gift of $100 or more will provide critical care for a state-endangered hatchling during its first year.

Make a Gift

With your tax-deductible donation of $100 or more, you'll become a part of the Ambassadors Circle, which offers recognition (if desired) and forest preserve experiences based on your level of support.

The Friends accepts financial and in-kind donations from individuals, corporations and groups that support DuPage forest preserves, programs and projects.

Levels of Support

- Recognition in the Friends’ annual report

- Recognition in the Friends’ annual report

- Recognition in the Conservationist

- Invitation to a special behind-the-scenes program

- Engraved leaf at District headquarters (for memorial or tribute gift, upon request)

- Recognition in the Friends’ annual report

- Recognition in the Conservationist

- Invitation to a special behind-the-scenes program

- Engraved leaf at District headquarters (for memorial or tribute gift, upon request)

- Willowbrook Wildlife Center Master Plan Improvements Project Campaign donor: Grand opening celebration invitation and recognition on donor wall (for one year)

- Recognition in the Friends’ annual report

- Recognition in the Conservationist

- Invitation to a special behind-the-scenes program

- Engraved leaf at District headquarters (for memorial or tribute gift, upon request)

- Recognition in Friends’ marketing

- Willowbrook Wildlife Center Master Plan Improvements Project Campaign donor: Grand opening celebration invitation and recognition on donor wall (for one year)

- Recognition in the Friends’ annual report

- Recognition in the Conservationist

- Invitation to a special behind-the-scenes program

- Recognition in Friends’ marketing

- Check presentation photo opportunity

- Willowbrook Wildlife Center Master Plan Improvements Project Campaign Donor: Grand opening celebration invitation and recognition on donor wall (for one year)

Individual donor's gifts at $2,500 or more are afforded our Community Partner benefits.

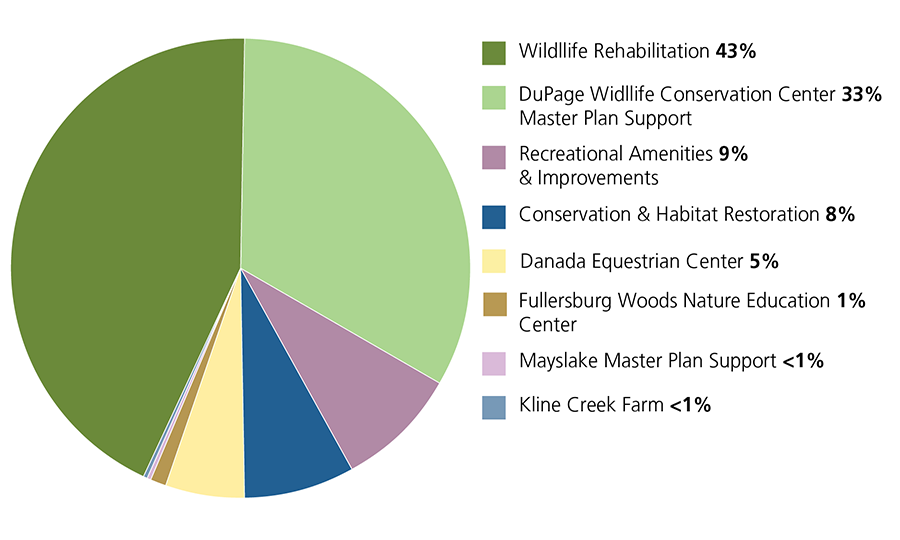

Your Impact to Benefit the Forest Preserve District

Where Your Gifts Made a Difference in 2025

Ways to Give

Methods

A gift of cash is the simplest, most convenient option and qualifies for the maximum allowable tax deduction. You can donate with your credit card, or with cash, check or credit.

Make your check payable to the Friends of the Forest Preserve District (or Friends FPDDC) and mail to:

Partnership & Philanthropy

Forest Preserve District of DuPage County

3S580 Naperville Road

Wheaton, IL 60189

Gifts of appreciated stocks and bonds allow you to deduct the current market value as a charitable deduction for the fair-market value of the stock.

A gift of life insurance allows you to make a generous gift at relatively low cost. By designating the Friends as a beneficiary of your policy, you receive an immediate tax deduction and eliminate the proceeds of the policy from your estate. All premium payments thereafter will also be tax-deductible, subject to IRS limitations. You can also transfer ownership of a paid-up policy or donate your insurance policy dividends.

Some businesses match gifts from an employee or the employee's spouse, doubling or tripling the value of the donation. To maximize the benefit, check with your employer about matching-gift programs, and contact the Friends if you need any documentation.

Gifts in Memory or Tribute

Honor a friend or loved one when you make a gift to the Friends of the Forest Preserve District.

Memorials or Tributes

Make your memorial or tribute gift online by first choosing your donation frequency and amount. Select “My gift is in memory/honor of” and enter the name of the individual or group you are honoring. In the “Gift from” field, please enter your name or the name of those you represent in making this gift.

Make your memorial or honorary gift by check to the Friends of the Forest Preserve District of DuPage County, and inidcate the individual your gift is in memory or honor of in its "memo" line. Mail to:

Partnership & Philanthropy

Friends of the Forest Preserve District of DuPage County

3S580 Naperville Road

Wheaton, IL 60189

Many families choose to request memorial gifts be made to the Forest Preserve District for a loved one. We hope one of the following suggestions will be helpful with your planning.

"It was (loved one’s name) wish that memorial tributes be made in the form of charitable donations to the Friends of the Forest Preserve District of DuPage County."

"In remembrance of (loved one’s name) life, the family asks that any charitable donations be made to the Friends of the Forest Preserve District of DuPage County."

"The family requests those who wish to express sympathy to consider donating to the Friends of the Forest Preserve District of DuPage County in (loved one’s name) memory."

Please contact us if you have questions or other needs.

Leaving Your Abundance to Nature

The Friends invites you to leave your own meaningful mark on the DuPage forest preserves by including the foundation in your will. You can change your bequest or trust designation at any time.

If you are interested in a planned gift, we'd advise you to speak to your personal tax and financial advisor and potentially your legal counsel about its benefits.

Types of Planned Gifts

Gifts by will or bequest are not subject to estate or inheritance taxes, so you can ensure your testamentary gift will have the maximum benefit for the forest preserves. You can contribute a specific dollar amount, a percentage of your assets or the remainder of your estate.

Consider naming the Friends as a beneficiary of your IRA or other retirement plan. If you are of a certain age and do not need your entire IRA income, you can take advantage of the charitable rollover provision, which allows annual tax-free charitable gifts of up to $100,000 per person directly from qualified IRAs. The distributions will count toward your annual required minimum, but you will not be taxed for the income you transfer, which can help lower the amount you own in taxes.

By establishing an endowment, you can be assured your charitable intentions will be followed for generations to come. Distributions from this type of permanent fund can provide substantial annual support for DuPage forest preserves in perpetuity.

Friends Board Meetings

Friends Board Meeting Dates

- Friends Board Meeting 01-20-2026

- Friends Board Meeting 11-18-25

- Friends Board Meeting 09-23-25

- Friends Board Meeting 07-15-25

- Friends Finance Committee Meeting 07-15-25

- Friends Board Meeting 05-20-25

- Friends Board Meeting 03-18-25

- Friends Development Committee Meeting 02-19-25

- Friends Board Meeting 01-21-2025

Our Board of Directors & Staff

The Friends of the Forest Preserve District is governed by a volunteer board of directors. These individuals are leaders in our DuPage community and support the Forest Preserve District's mission.

Board of Directors

Chair Jeanette Wells

Vice Chair David Stang

Treasurer Tom Murphy

Secretary Joseph Suchecki

Ex-Officio Member Jeff Gahris

Member Mike Dyer

Member Ashley Guest

Member Denise Krohn

Member Larry C. Larson

Member Carl Schultz

Member Tom Williams

Staff

Executive Director Jeannine Kannegiesser

Our Finances & Governance

Friends Annual Reports

Friends 990 Reports

Friends Policies

Be Our Partner

Our community partners program is designed for organizations, clubs, and businesses interested in giving back and enhancing the quality of life for all DuPage residents. Align your mission and values with recognition opportunities based on your level of generosity.

With Special Thanks to Our Partners

ComEd

CNH Industrial Foundation

Domtar

Ecolab Foundation

Edward Jones — Financial Advisor Mike Dyer

Ferrari Plumbing, Inc.

Friends of Danada, Inc.

G. Carl Ball Family Foundation

GreenState Credit Union

International

Kerschen Family Fund

Komarek-Hyde-McQueen Foundation

Mary J. Demmon Private Foundation

Molex

Nicor Gas Company

nora fleming

Ranch Spur Charitable Trust

Republic Bank of Chicago

Robert & Toni Bader Charitable Foundation, Inc.

Stantec Consulting Services, Inc.

TC Energy

Tyndale House Publishers

V3 Companies

Wheaton Bank & Trust

"I give back to the Forest Preserve District, because I love nature. Other people can donate to the Friends of the Forest Preserve District for the same reasons I do: To make certain that nature is maintained, accessible, and here for future generations."

Larry C. Larson

Naperville

Friends of the Forest Preserve District

To advance the vision of the Forest Preserve District through philanthropic endeavors

Annual Donors

Ambassador Circle Donors

Community Partners

General Info

Partnership & Philanthropy

Friends of the Forest Preserve District of DuPage County

3S580 Naperville Road

Wheaton, IL 60189

630-871-6400

fundraising@dupageforest.org