Budgets and Financial Reports

Our Forest Preserve District's finance department works with all departments to budget funding sources to aid in the conservation of land and natural resources and provide nature-related programs for DuPage residents and forest preserve visitors.

The District follows sound management principles in its commitment to the planning and use of its financial resources. It maintains a AAA rating from Standard and Poor's based on strong financial operations, fiscally responsible reserves, and disciplined budgeting practices. This superior rating has also enabled the District to attain successful bond sales over our history. In January 2025, the District earned a AAA rating from Standard & Poor’s Global Ratings for its series 2024 general obligation limited-tax bonds, which will be used to pay for certified master plan projects without raising debt-servicing costs or increasing taxes.

Certificate of Achievement for Excellence in Financial Reporting

The Government Finance Officers Association awarded the Forest Preserve District its Certificate of Achievement for Excellence in Financial Reporting 36 times. The association developed the program to encourage agencies and professionals to “prepare comprehensive annual financial reports that evidence the spirit of transparency and full disclosure.” Participation and recognition by the award programs exemplify the District's commitment to sound financial practices and stewardship to the residents of DuPage County.

Taxes and Funding

Taxes

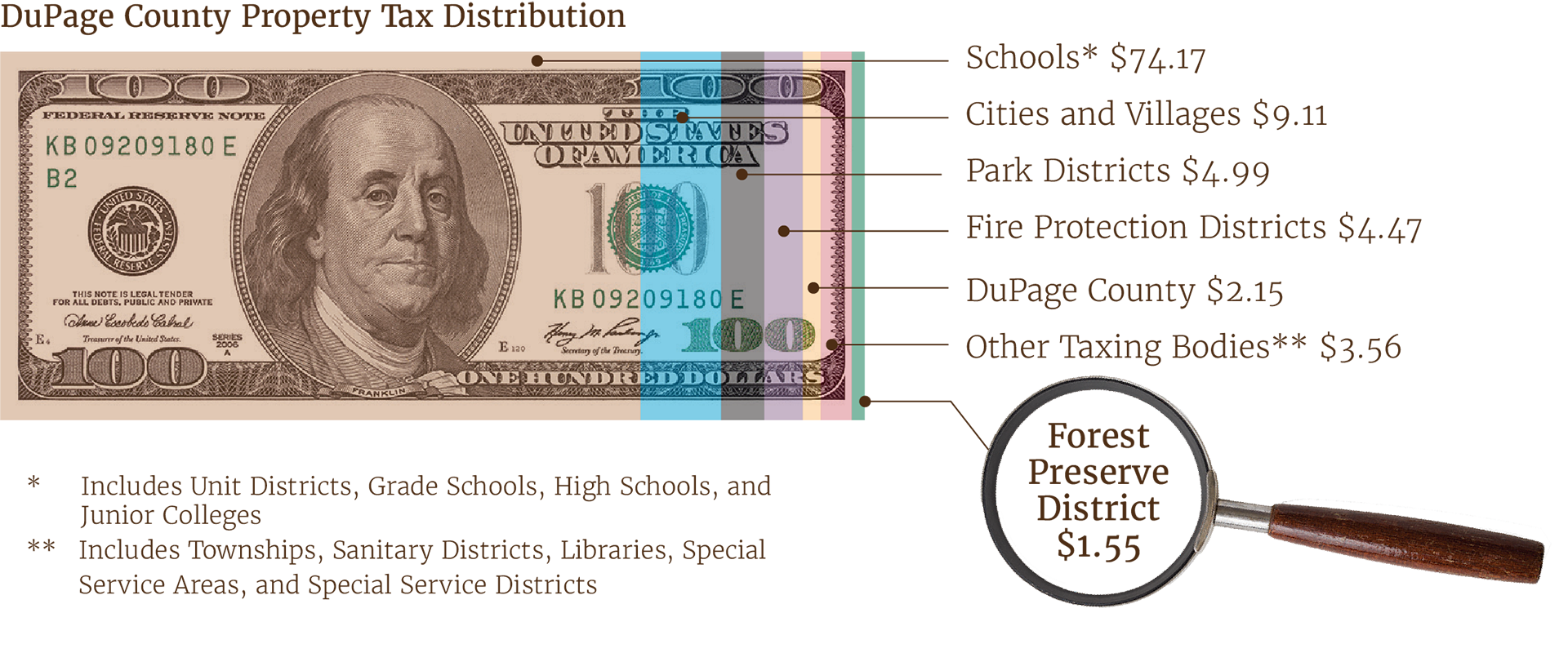

While nearly three-quarters of a DuPage County homeowner's tax bill goes to support schools, just $1.55 of every $100 paid funds all of the services the Forest Preserve District provides.

Fees

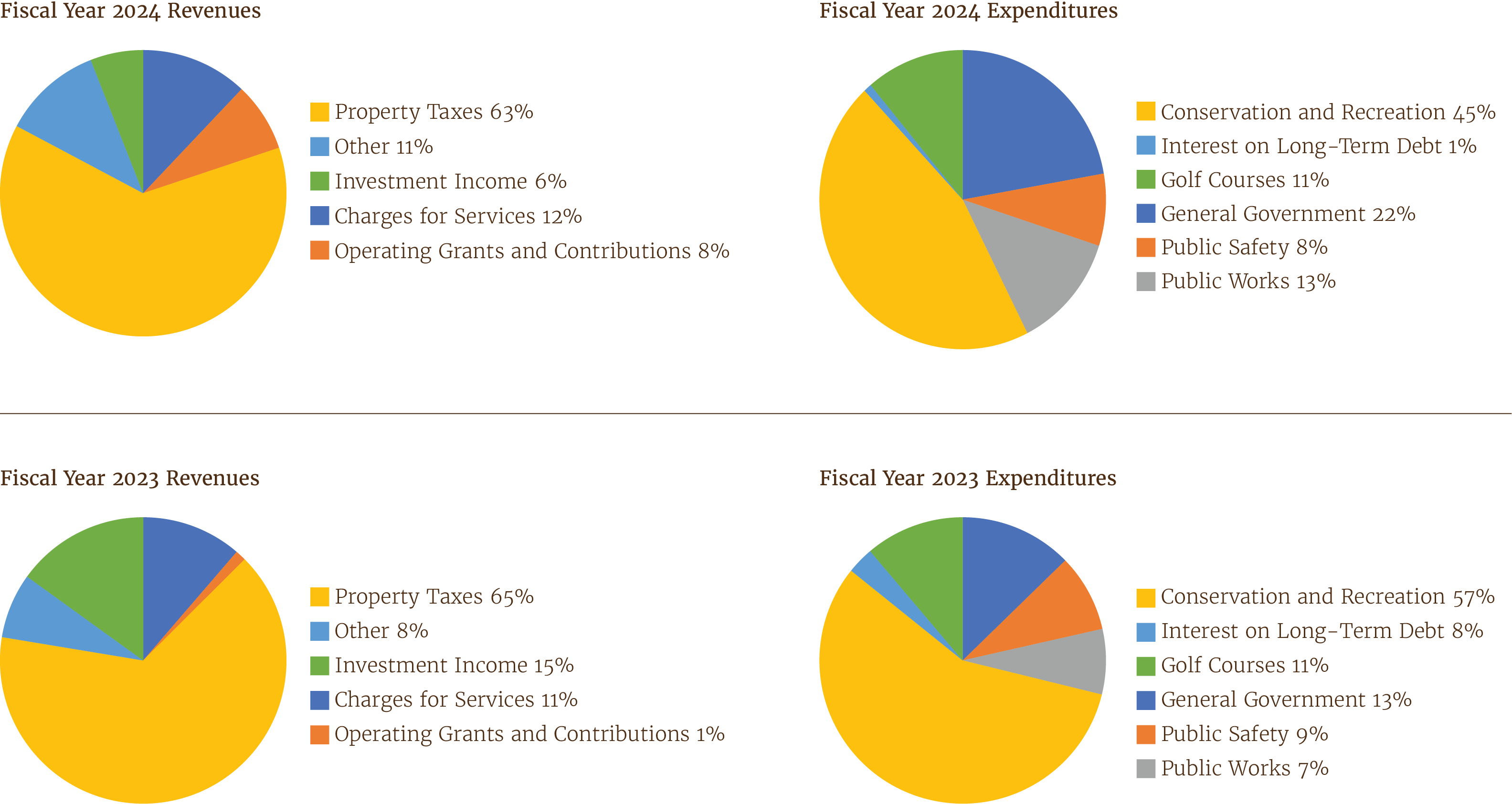

The District also charges residents certain fees and permits for use of facilities and services. Those charges make up about 12% of the District’s overall revenues.

Revenues and Expenditures

To report on its financial position and the results of its operations, the District uses fund accounting, which demonstrates legal compliance and aids financial management by segregating transactions related to certain functions and activities. Funds are either governmental or proprietary. Governmental funds account for most of the District’s general activities, such as land acquisition, capital development, servicing of general bonded debt and general operations. Proprietary funds account for business-type activities and receive a significant portion of their funding from user fees.

Annual Budgets

The budget is the foundation of the Forest Preserve District’s annual financial planning and is a tool that staff uses to manage daily operations. Each budget year begins on Jan. 1 and ends on Dec. 31. All offices submit budget requests, which serve as a starting point for the development of the comprehensive document. Taking comments into consideration, the board of commissioners reviews and revises the appropriation before its adoption. Although not a formal part of the appropriation ordinance, the Forest Preserve District uses a five-year projection of revenues and capital expenditures in its financial planning.

- Proposed 2025 Amended Annual Appropriation Ordinance (PDF)

- Proposed 2026 Appropriation and Budget (PDF)

- 2025 Budget (PDF)

- 2024 Budget (PDF)

- 2023 Budget (PDF)

- 2022 Budget (PDF)

- 2021 Budget (PDF)

Annual Comprehensive Financial Reports

The Forest Preserve District is required to publish a complete set of financial statements presented in conformance with generally accepted accounting principles and audited in accordance with generally accepted auditing standards by a firm of licensed certified public accountants.

Citizens Guide to Financial Reports

The Citizens Guide to Financial Reports summarizes the financial activities of the Forest Preserve District and provides a general understanding and summary of the major initiatives and financial activities in a fiscal year. It is not intended to replace the full disclosure financial statements.